CARMOOLA Secures £100 Million Debt Deal with NatWest to Support Car Financing Expansion

UK-based fintech Carmoola, specializing in direct-to-consumer car financing, has reached a significant milestone in its expansion with the announcement of a £100 million (€116 million) debt facility from NatWest, one of the largest banks in the UK. This deal is part of Carmoola’s strategy to democratize access to car financing by eliminating traditional intermediaries and making the process more transparent, faster, and accessible to consumers. The partnership aims to boost car sales and loan originations, with the goal of generating several billion pounds in loans over the next five years.

Disruptive Strategy in a Traditional Market

Founded in March 2022 by AIDAN RUSHBY, AMY MCKECHNIE, ROMAN SUMNIKOV, and IHOR HORDIYCHUK, Carmoola has quickly positioned itself as a game-changer in the car financing sector. Through its app, the startup offers a direct-to-consumer model, allowing users to access competitive financing options without going through traditional car dealerships. Carmoola’s digital platform simplifies the entire process—from loan application and vehicle verification to purchase—while reducing the costs and paperwork typically associated with car financing.

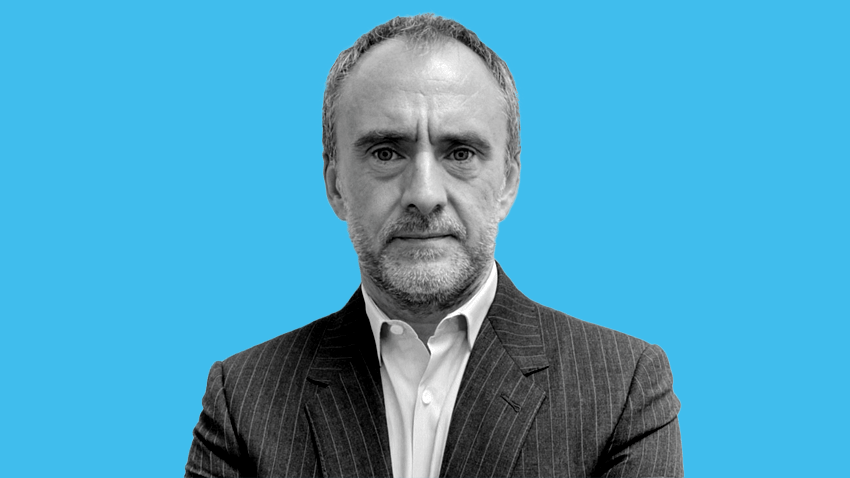

AIDAN RUSHBY, co-founder and CEO of Carmoola, expressed his excitement about the NatWest deal, highlighting the company’s commitment to improving the consumer experience in a traditionally opaque industry:

“We’ve been working on this partnership for some time, and we’re thrilled to now offer our customers even more competitive rates. This deal allows us to continue transforming car financing, making it simpler, more transparent, and fairer for everyone.”

An Ambitious Vision for the Future

The agreement with NatWest strengthens Carmoola’s position in the UK market, which currently represents £100 billion in used car financing. This market is projected to grow to £190 billion by 2027. The goal is to enable more consumers to access financing solutions without the traditional hurdles imposed by conventional lenders and car dealerships.

In just two years, Carmoola has already financed over £46 million worth of cars, proving the effectiveness of its model. The addition of this £100 million debt financing will allow the startup to meet increasing demand while accelerating its expansion across the UK. This new capital will support loan origination, enabling thousands of consumers to purchase vehicles through a simpler, more advantageous financing solution.

Strong Support from Investors

This is not the first time Carmoola has attracted attention from major financial institutions. In January 2024, the startup raised £15.5 million (€18 million) in a Series A round led by QED Investors, VentureFriends, InMotion Ventures (Jaguar Land Rover’s investment arm), AlleyCorp, and u.ventures. This round followed an earlier fundraising in February 2023, which included £8.5 million (€9.9 million) in equity and another £95 million (€110 million) debt facility from NatWest.

Carmoola’s investors emphasize the company’s customer-centric approach and its ability to disrupt a sector historically dominated by traditional lenders:

“Carmoola is tackling the flaws in the traditional market by removing the unnecessary hurdles imposed by lenders and offering a fairer alternative for consumers. Their success is a clear testament to the value they bring to the market,” said YUSUF ÖZDALGA, partner at QED Investors.